wELCOME TO BRIDGIT CARE

Carer Support

Providing support to unpaid carers, councils and carer charities

Supported by

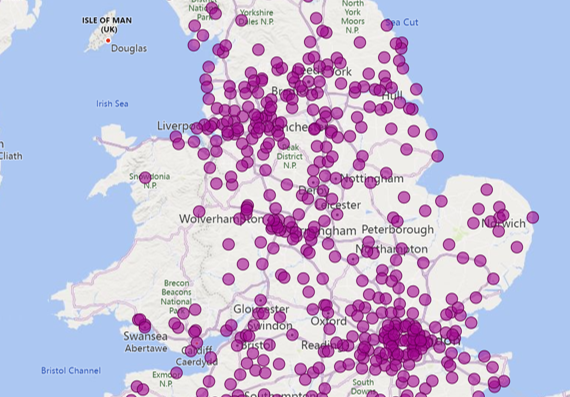

Supporting Carers Across the UK

Areas Bridgit has already supported carers across the UK

Are you an unpaid carer and looking for support? Then we’re here for you.

Bridgit Care is an organisation that helps unpaid carers across the UK. They are supported by the government.

There are more than 6.5 million carers in the UK. Many of them are unknown to organisations and professionals and do not receive support in their caring role or personal lives.

Bridgit Care aims to change this.

“Taking care of someone can be tough and it can leave you with no time to look after yourself. Bridgit Care is here to help. We’ll take care of you, so you can take care of them.” Bridgit Care

Free Online Support for Carers

Bridgit Self-help

Access instant & personalised support

Caring for someone can be hard, and it’s tough to find the help you need when you’re busy.

There’s so much information available that it’s confusing to know where to begin.

That’s why we created a special tool that gives you the information you need when you need it, customised for the needs of carers.

Ask Bridgit

Chat with your virtual carer coach

Ask Bridgit chats to you and finds out what as a carer you are finding difficult, and may need support with.

Instant advice is provided, along with a self-help support plan; highlighting suggestions, tips and local events.

You can ask Bridgit anything. All you need is WhatsApp and 5 minutes to share some information about your role as a carer and access support local to you.

What Carers Say

“So far I’ve learned about so much out there I had no idea about. Absolutely invaluable. Thank you so much.”

Carer for mum And sister

“The self help tool brings everything I need into one place, and if I need extra help I know where to get it. ”

Carer FOr MOther-IN-LaW

“The support has helped me find local support and events for me and my son. The email reminders have been good and helped me think about things.”

Parent carer

Are you a Council, NHS Provider, or Charity looking for innovative ways to support your carers?

Bridgit Care works with Councils, the NHS and Carer Charities across the UK, to help identify carers and scale the support provided with the use of technology.

Bridgit Care provides support with :

- Identification – Increase the number of carers identified and in support.

- Self Help – Scale carer support and reduce system demands.

- Connection – Helping to connect and signposting carers.

- Support – Improving carers access to support at the point they need it.

- Reporting & Benefits – Insights to help improve support and system reduce demands.

- Carers & Smart Assessments – Increase access to extra help when needed and reduce administration.

“Bridgit is an exciting and important step for the council to encourage more people who care for others to access the free support they are entitled to. To have shaped Bridgit with local expert input has been excellent and I encourage anyone who is or thinks they may be a carer, to simply explore Bridgit for themselves.”

COUNCILLOR

Meet the team

Bridgit Care’s Newest WhatsApp Feature: AI-Powered Falls Risk Assessment

Helping Carers and the people they care for to stay safe at home 🌟 We’re excited to announce a groundbreaking

Social Care Innovation & the Accelerating Reform Fund

Social Care Innovation & the Accelerating Reform Fund: Uniting for a Brighter Future in Care 🌟 Big news in the

Bridgit Care supporting Carers over the Winter Period

Supporting Carers Through the Winter Pressures As the frost begins to settle and the nights draw in, we at Bridgit